| पोस्ट किया |

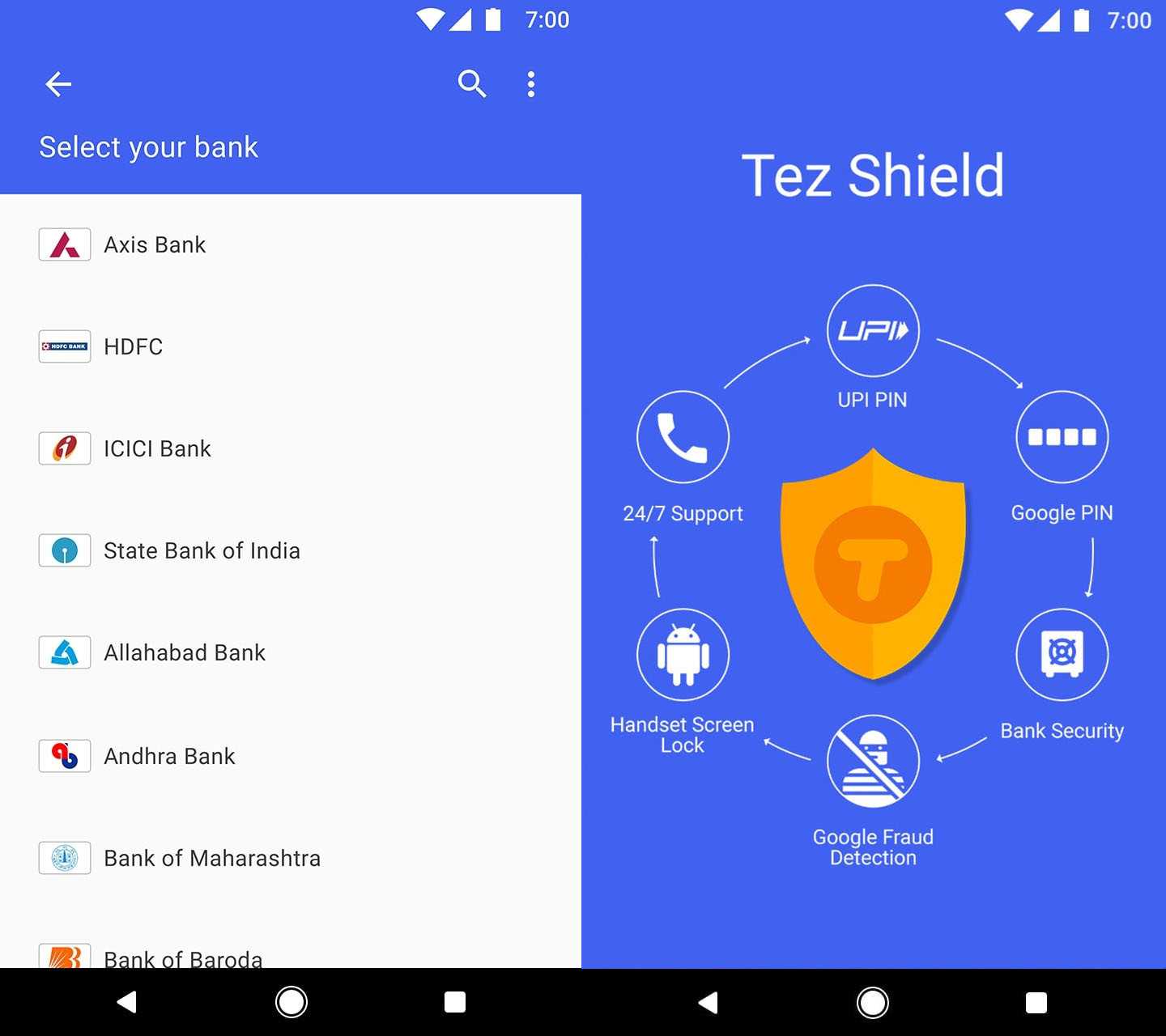

What are the features of the Google Pay app “Tez”?

Software engineer at HCL technologies | पोस्ट किया

Tez was launched by Google in September last year. And after one year, Google has rebranded it as Google Pay, announcing the partnership HDFC Bank, ICICI Bank, Federal Bank and Kotak Mahindra Bank. The partnership is being initiated for the pre-approved loans.

On android play store, Google Tez has crossed 50 million downloads. Other features of Google Tez:

On android play store, Google Tez has crossed 50 million downloads. Other features of Google Tez:

0

0 टिप्पणी

Kanpur | पोस्ट किया

- Instant transfer of money can be carried out through the app.

- Transactions made through the app are safe and secure and are protected by Tez Shield that provides a multi-layered security with 24×7 protection from frauds.

- The app makes it easy to pay or transfer money both in big as well as small amounts.

- Users can send or receive money instantly with the Cash Mode without sharing their personal or bank details.

- The app supports 8 Indian languages.

- As per now, payments cannot be made through debit or credit cards but the feature will soon be available for users.

- Users will also be able to set reminders and make payments periodically for DTH, utility bills, etc. in future.

0

0 टिप्पणी

Student | पोस्ट किया

Tez was launched by Google in September last year. And after one year, Google has rebranded it as Google Pay, announcing the partnership HDFC Bank, ICICI Bank, Federal Bank, and Kotak Mahindra Bank. The partnership is being initiated for pre-approved loans.

0

0 टिप्पणी

| पोस्ट किया

0

0 टिप्पणी

student | पोस्ट किया

hello,

google pay is a financial app of google and it is latest version of tez.

Built for India with all the features and rewards you love, plus much more.

Google Pay is the simplest way to send money home to your family, recharge your mobile, or pay the neighbourhood chaiwala.

0

0 टिप्पणी

Blogger | पोस्ट किया

0

0 टिप्पणी